Introduction: Navigating the Volatile Steel Market in 2026

Why Steel Prices Matter for Buyers and Investors

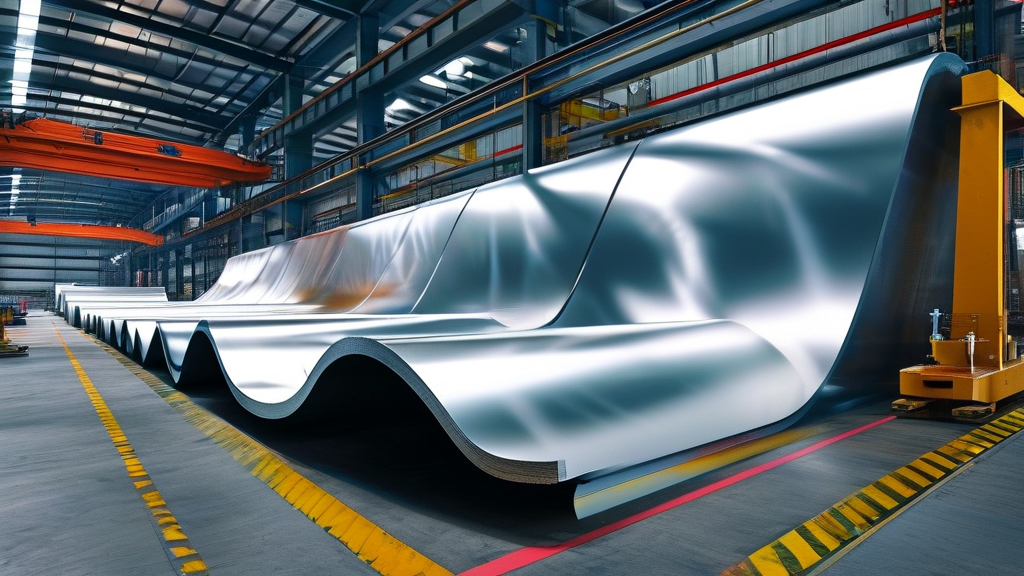

Steel remains the backbone of global industrial activity, underpinning sectors from construction and automotive to energy and infrastructure. For procurement leaders, manufacturers, and investors, understanding steel price trends is not just about cost control—it’s a strategic imperative. In 2026, with markets still adjusting to post-pandemic realities and geopolitical shifts, the ability to anticipate price movements in both carbon and stainless steel can mean the difference between profitability and margin erosion.

Key Factors Shaping the 2026 Steel Outlook

Several interrelated forces will drive steel pricing in 2026: supply chain resilience, raw material volatility, energy costs, and macroeconomic policy. Buyers must move beyond reactive purchasing and adopt a forward-looking approach grounded in data and market intelligence. This article provides a comprehensive forecast for carbon and stainless steel prices in 2026, identifying optimal buying windows and strategic procurement tactics.

Global Steel Market Overview: Setting the Stage for 2026

Post-Pandemic Recovery and Industrial Demand Trends

The global steel market has largely rebounded from pandemic-induced disruptions, but recovery has been uneven. While North America and Europe have seen steady demand growth driven by infrastructure investments, parts of Asia-Pacific are experiencing slower industrial expansion due to property sector challenges in China. Overall, global crude steel production is projected to grow at a modest 1.8% annually through 2026, with demand increasingly concentrated in green energy and advanced manufacturing sectors.

Geopolitical Tensions and Trade Policy Impacts

Trade policies continue to reshape steel flows. U.S. Section 232 tariffs, EU carbon border adjustments (CBAM), and China’s export restrictions on critical raw materials are creating regional price disparities. These measures, combined with ongoing tensions in key shipping corridors, add layers of complexity to global supply chains. Buyers must factor in not only base metal costs but also logistics premiums and compliance overhead.

Energy Costs and Their Influence on Production Economics

Energy represents up to 30% of steel production costs, particularly in electric arc furnace (EAF) operations. With natural gas and electricity prices expected to remain elevated in Europe and parts of North America through 2026, production costs will stay under upward pressure. Regions with access to low-cost renewable energy—such as parts of Scandinavia and the Middle East—may gain a competitive edge in export markets.

Carbon Steel Price Forecast 2026: Trends and Turning Points

Supply Chain Stabilization and Inventory Levels

After years of volatility, global steel supply chains are stabilizing. Inventory levels at distributors and end-users have normalized, reducing panic buying and speculative stockpiling. This equilibrium supports more predictable pricing, though regional imbalances persist. North American inventories are lean due to strong construction demand, while European stockpiles remain elevated amid sluggish industrial activity.

Infrastructure Spending and Construction Sector Demand

Government-led infrastructure programs—such as the U.S. Infrastructure Investment and Jobs Act and the EU’s Green Deal Industrial Plan—will sustain demand for structural and rebar carbon steel through 2026. However, residential construction slowdowns in key markets may offset some gains. Analysts project carbon steel prices to average $720–$780 per metric ton in 2026, with peaks during high-demand seasons.

Raw Material Costs: Iron Ore, Coking Coal, and Scrap Metal Dynamics

Iron ore prices are expected to soften slightly due to increased supply from Australia and Brazil, but coking coal remains tight, supporting blast furnace production costs. Scrap metal, a key input for EAFs, will see fluctuating prices tied to automotive recycling rates and export controls. Buyers should monitor the iron ore-to-scrap price ratio, as shifts can signal cost advantages for specific production routes.

Regional Price Divergences: U.S., EU, and Asia-Pacific Markets

Price spreads between regions will widen in 2026. U.S. carbon steel prices are likely to remain 10–15% above global averages due to protectionist policies and strong domestic demand. The EU faces upward pressure from CBAM-related compliance costs, while Asia-Pacific prices—led by China—may trend lower due to oversupply and weak domestic consumption.

Stainless Steel Price Forecast 2026: Nickel, Chromium, and Market Volatility

The Role of Nickel Prices in Stainless Steel Pricing

Nickel accounts for 60–70% of stainless steel production costs, making it the primary price driver. With new Indonesian nickel supply entering the market, Class 1 nickel premiums are expected to decline, but battery-sector demand will keep prices volatile. Stainless steel prices in 2026 are forecast to range between $2,100 and $2,400 per metric ton, heavily influenced by LME nickel futures.

Environmental Regulations and EAF Adoption in Stainless Production

Stricter emissions standards are accelerating the shift toward EAF-based stainless production, which uses higher scrap ratios and reduces carbon intensity. This transition may lower long-term production costs but requires significant capital investment. Suppliers with modern EAF capabilities will likely offer more competitive pricing by mid-2026.

Demand from Automotive, Aerospace, and Renewable Energy Sectors

Stainless steel demand is being reshaped by electrification and sustainability trends. The automotive sector’s shift to electric vehicles (EVs) is increasing demand for high-performance grades used in battery enclosures and exhaust systems. Similarly, wind and solar installations require corrosion-resistant alloys, creating steady off-take from the renewable energy sector.

China’s Dominance and Export Policies Affecting Global Supply

China produces over 60% of the world’s stainless steel and continues to influence global pricing through export quotas and domestic consumption policies. Any reduction in Chinese exports—driven by environmental crackdowns or trade disputes—could trigger short-term price spikes. Buyers should diversify sourcing to mitigate reliance on a single supply hub.

Macroeconomic Indicators to Watch in 2026

Inflation, Interest Rates, and Their Impact on Industrial Buying

Central bank policies will play a critical role in 2026. If inflation remains stubbornly high, prolonged high interest rates could dampen capital-intensive projects, reducing steel demand. Conversely, rate cuts in response to slowing growth may stimulate construction and manufacturing activity, pushing prices higher.

Currency Fluctuations and Dollar Strength

A strong U.S. dollar makes dollar-denominated commodities like steel more expensive for buyers in emerging markets, potentially reducing global demand. Conversely, a weaker dollar could boost exports from the U.S. and EU, tightening supply and supporting prices. Procurement teams should consider currency hedging strategies when negotiating long-term contracts.

Global GDP Growth Projections and Industrial Output

The IMF projects global GDP growth of 3.1% in 2026, with emerging markets leading the expansion. Strong industrial output in India, Southeast Asia, and parts of Africa will drive incremental steel demand. However, stagnation in advanced economies may cap overall price growth, creating a bifurcated market landscape.

Seasonal and Cyclical Patterns in Steel Pricing

Historical Price Cycles: Lessons from 2020–2024

Analysis of recent cycles shows that steel prices typically trough in Q1, rise through Q2 and Q3 with construction activity, and soften in Q4 as inventories are drawn down. The 2020–2024 period also revealed increased volatility due to supply shocks, underscoring the need for agile procurement strategies.

Seasonal Demand Spikes in Construction and Manufacturing

Spring and early summer remain peak seasons for steel consumption, particularly in the Northern Hemisphere. Buyers should anticipate price increases of 5–8% during these periods. Conversely, winter months often see reduced activity and softer pricing, especially in regions with harsh weather conditions.

Inventory Build-Up Periods and Buyer Behavior

Distributors often build inventory in late Q4 in anticipation of Q1 demand, which can temporarily inflate prices. Savvy buyers can exploit post-holiday lulls when suppliers are motivated to clear excess stock. Monitoring inventory reports from major mills and traders provides early signals of market direction.

When Is the Best Time to Buy? Strategic Timing for 2026

Q1 2026: Post-Holiday Lull and Potential Price Softening

January and February typically offer the most favorable buying conditions, with reduced demand and supplier incentives to move inventory. This window is ideal for locking in forward contracts or securing bulk purchases at discounted rates.

Q2 2026: Spring Construction Surge and Rising Demand

As construction activity ramps up, prices are likely to climb. Buyers with flexible timelines should consider partial pre-buying in late Q1 to avoid Q2 premiums. However, those with urgent needs may find limited discounts during this period.

Q3 2026: Mid-Year Inventory Adjustments and Supplier Promotions

Some mills offer mid-year promotions to meet annual targets, particularly in July and August. This can be a strategic window for medium-term procurement, especially if macroeconomic conditions remain stable.

Q4 2026: Year-End Procurement and Forward Contract Opportunities

December often sees a rush to finalize annual budgets, leading to increased demand. However, suppliers may offer favorable terms on forward contracts for 2027 delivery. Buyers should negotiate early to secure volume discounts and flexible payment terms.

Risk Mitigation and Procurement Strategies

Hedging Against Price Volatility with Futures and Contracts

Utilizing LME or Shanghai Futures Exchange contracts allows buyers to lock in prices and reduce exposure to spot market swings. Long-term fixed-price agreements with suppliers also provide stability, though they require careful volume forecasting.

Diversifying Suppliers and Regional Sourcing

Relying on a single supplier or region increases risk. Building a diversified supplier base across North America, Europe, and Asia-Pacific enhances resilience. Nearshoring to Mexico or Eastern Europe can also reduce lead times and logistics costs.

Building Strategic Inventory Buffers Without Overstocking

Maintaining a 4–6 week inventory buffer for critical grades can protect against supply disruptions. However, overstocking ties up capital and risks obsolescence. Just-in-time (JIT) models should be balanced with safety stock for high-impact materials.

Expert Recommendations for Buyers in 2026

Monitor Leading Indicators: PMI, Freight Rates, and Commodity Indices

Track the Global Manufacturing PMI, Baltic Dry Index, and CRB Commodity Index for early signals of demand shifts. A rising PMI often precedes steel price increases, while falling freight rates may indicate softening demand.

Leverage Data Analytics and Price Forecasting Tools

Advanced analytics platforms can model price scenarios based on raw material costs, currency trends, and demand forecasts. Integrating these tools into procurement workflows enables proactive decision-making.

Collaborate with Suppliers for Volume Discounts and Flexible Terms

Long-term partnerships with trusted suppliers like Baoli Iron & Steel can yield preferential pricing, priority allocation during shortages, and customized delivery schedules. Open communication and shared forecasting improve mutual resilience.

Conclusion: Preparing for a Strategic Steel Purchase in 2026

Final Takeaways for Procurement Leaders and Investors

2026 presents both challenges and opportunities in the steel market. While prices are expected to remain volatile, informed buyers can capitalize on seasonal dips, macroeconomic trends, and strategic sourcing to optimize costs. Carbon steel will benefit from infrastructure spending, while stainless steel will be shaped by nickel dynamics and green technology demand.

The Importance of Agility in a Dynamic Market Environment

In an era of rapid change, agility is paramount. Procurement strategies must be flexible, data-driven, and collaborative. By aligning purchasing decisions with market cycles, monitoring key indicators, and building resilient supply chains, organizations can navigate the complexities of the 2026 steel market with confidence.