As of February 22, 2025, China’s stainless steel industry continues to play a pivotal role in the global market, particularly in terms of exports. Despite facing domestic challenges such as declining consumption and stricter environmental regulations, China remains the world’s largest producer and exporter of stainless steel. This article explores the recent trends, driving factors, and challenges shaping China’s stainless steel export landscape, offering insights into its global impact.

Export Growth Amid Domestic Slowdown

In 2024, China’s stainless steel exports reached a historic high, with total exports amounting to 110.72 million tons, according to industry reports. This marked a significant increase of 22.7% compared to 2023, when exports stood at 94.5 million tons. The surge in exports comes despite a 1.7% decline in steel production, which dropped to a five-year low of approximately 1 billion tons in 2024. This paradox is largely driven by weak domestic demand, particularly in the construction and industrial sectors, which have historically been the backbone of China’s steel consumption. With the Chinese government enforcing strict debt control policies and a slowing real estate market, producers have turned to international markets to offload excess capacity.

The first months of 2025 suggest this trend is persisting. December 2024 alone saw exports of 9.72 million tons, higher than the monthly average for the year, indicating sustained foreign demand. Key export destinations include Southeast Asia, South Asia, and the Middle East, regions benefiting from China’s Belt and Road Initiative (BRI) infrastructure projects. Countries like Vietnam and India have emerged as significant importers, with Vietnam seeing a sharp rise in demand in 2024, importing 43,200 tons in March alone.

Factors Driving Export Success

Several factors contribute to the robust growth of China’s stainless steel exports. First, competitive pricing remains a key advantage. Chinese producers have capitalized on lower production costs and economies of scale to offer stainless steel at prices that undercut competitors in markets like the United States and the European Union. Despite a global oversupply and declining steel prices—exacerbated by China’s export surge—this pricing strategy has attracted buyers in developing economies.

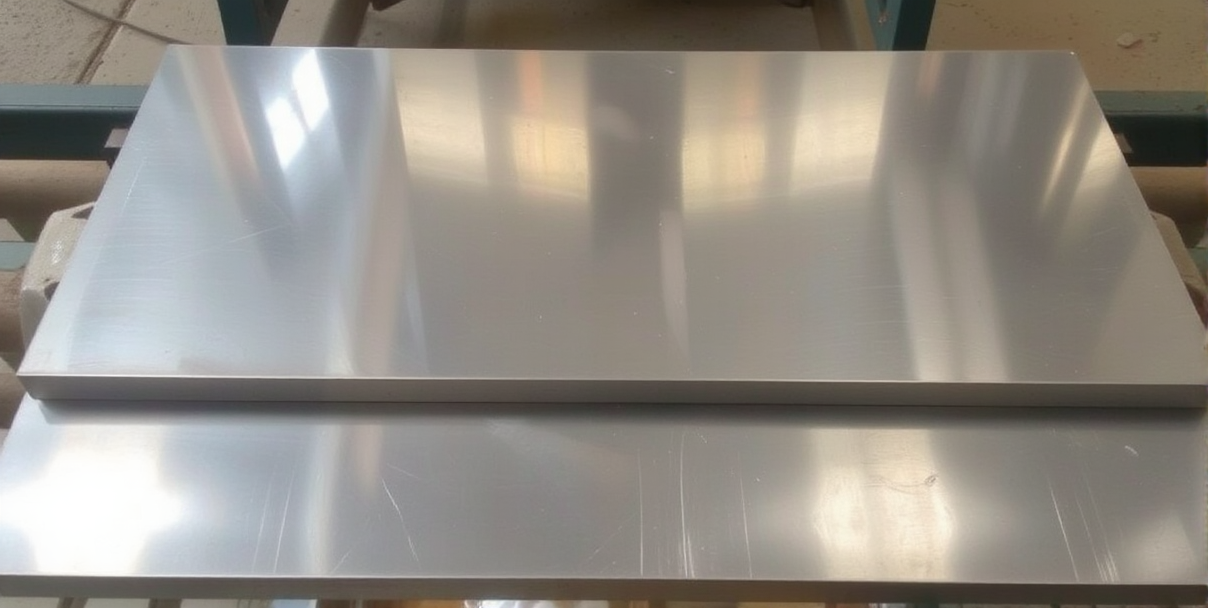

Second, the quality of Chinese stainless steel has improved significantly, thanks to technological advancements and investments in research and development. The 300-series stainless steel, known for its corrosion resistance and durability, dominates exports, accounting for a substantial portion of the market. This aligns with rising global demand for high-quality materials in industries such as automotive, construction, and manufacturing.

Third, the closure of stainless steel mills in other regions, coupled with supply chain disruptions elsewhere, has shifted demand toward China. For instance, weakened production in Europe due to high energy costs and geopolitical tensions has created opportunities for Chinese exporters to fill the gap.

Challenges and Trade Barriers

While China’s export strategy has been successful, it is not without challenges. The influx of cheap Chinese stainless steel has sparked global concerns about market dumping, prompting a wave of trade barriers. In 2024, importing countries initiated 25 anti-dumping investigations—the highest since 2016—targeting Chinese steel products. The United States, under President Donald Trump’s second administration, imposed an additional 10% tariff on all Chinese imports, including stainless steel, effective February 1, 2025. This builds on previous tariffs, further complicating access to the U.S. market, where exports have already declined from 1.2 million tons in 2018 to 815,000 tons in 2023.

Other nations, such as India, Mexico, and Brazil, have also introduced protective measures. India imposed an 18.95% countervailing duty on certain Chinese stainless steel products in 2023, while Mexico raised tariffs to 80% in 2024. These actions reflect a growing push to shield domestic industries from the flood of Chinese steel, potentially capping export growth in the coming years.

Additionally, environmental pressures within China pose a long-term challenge. The government’s carbon neutrality goals and stricter emission standards have led to production cuts, with no new steel mills approved since August 2024. This could constrain supply if domestic policies tighten further, forcing producers to balance export ambitions with sustainability mandates.

Future Outlook

Looking ahead, China’s stainless steel exports are expected to remain high in 2025, driven by excess capacity and ongoing demand from developing markets. However, the sustainability of this growth is uncertain. Analysts predict that by 2026, exports may decline as more countries implement trade controls and global demand stabilizes. Chinese producers are adapting by investing in overseas facilities, particularly in BRI countries like Thailand and Indonesia, to circumvent tariffs and maintain market presence.

For now, China’s stainless steel industry continues to shape global supply chains, offering both opportunities and disruptions. Its ability to navigate trade tensions, environmental regulations, and shifting market dynamics will determine its future trajectory as a dominant player in the international arena.

Key Specifications

- Standards and grades

- Dimensions and tolerances

- Surface finish

- Certificates (MTC)

Applications

Construction, machinery, energy and general fabrication — match material and finish to the operating environment.