## The Rise of China’s 201 Stainless Steel Rectangular Tube Factories

China has become a global powerhouse in the manufacturing sector, and the production of 201 stainless steel rectangular tubes is no exception. The country boasts a vast network of factories dedicated to producing this versatile material, playing a significant role in supplying both domestic and international markets. This essay will explore the factors contributing to China’s dominance in this industry, the challenges faced by these factories, and the future outlook for this sector.

One of the primary drivers behind China’s success is its abundant supply of raw materials. The country possesses extensive reserves of chromium and nickel, two crucial components in the production of stainless steel. This readily available resource base allows Chinese factories to maintain competitive pricing and achieve economies of scale. Furthermore, China’s vast manufacturing infrastructure, including sophisticated machinery and a readily available workforce, provides a fertile ground for the development of numerous 201 stainless steel rectangular tube factories. These factories range from small, specialized operations to large-scale industrial complexes capable of producing millions of tubes annually.

The competitive landscape is fierce. Chinese factories compete primarily on price, often undercutting international competitors. This aggressive pricing strategy, coupled with efficient production methods and substantial production capacity, has enabled them to secure a significant market share. However, this intense competition has also led to challenges. Maintaining consistent product quality while minimizing costs is an ongoing struggle. Furthermore, meeting international standards and certifications, particularly regarding environmental regulations, remains a hurdle for some factories. The push for sustainability and stricter environmental regulations is forcing many factories to invest in cleaner production methods and more sustainable practices.

The future of China’s 201 stainless steel rectangular tube industry is intertwined with global economic trends and technological advancements. Increased demand from developing nations, particularly in infrastructure projects and construction, is expected to fuel growth. However, fluctuating commodity prices and global trade tensions pose ongoing risks. The adoption of automation and advanced manufacturing technologies, such as robotics and AI, will be crucial for maintaining competitiveness and improving efficiency. Factories investing in research and development will be better positioned to meet evolving market demands and produce higher-quality, specialized products.

In conclusion, China’s 201 stainless steel rectangular tube factories have established a dominant position in the global market, driven by abundant resources, a robust manufacturing infrastructure, and a competitive pricing strategy. While challenges remain, particularly in maintaining quality, adhering to environmental standards, and navigating global economic uncertainties, the industry’s future prospects remain positive. Continued investment in technology and sustainable practices will be key to ensuring the long-term success of this vital sector within the Chinese economy and its contribution to the global supply chain.

China 201 Stainless Steel Rectangular Tube Factories: Market Dominance, Challenges, and Future Outlook — This article provides a practical buyer‑focused overview with specifications, selection tips, and on‑site considerations. Explore related topics: blog.

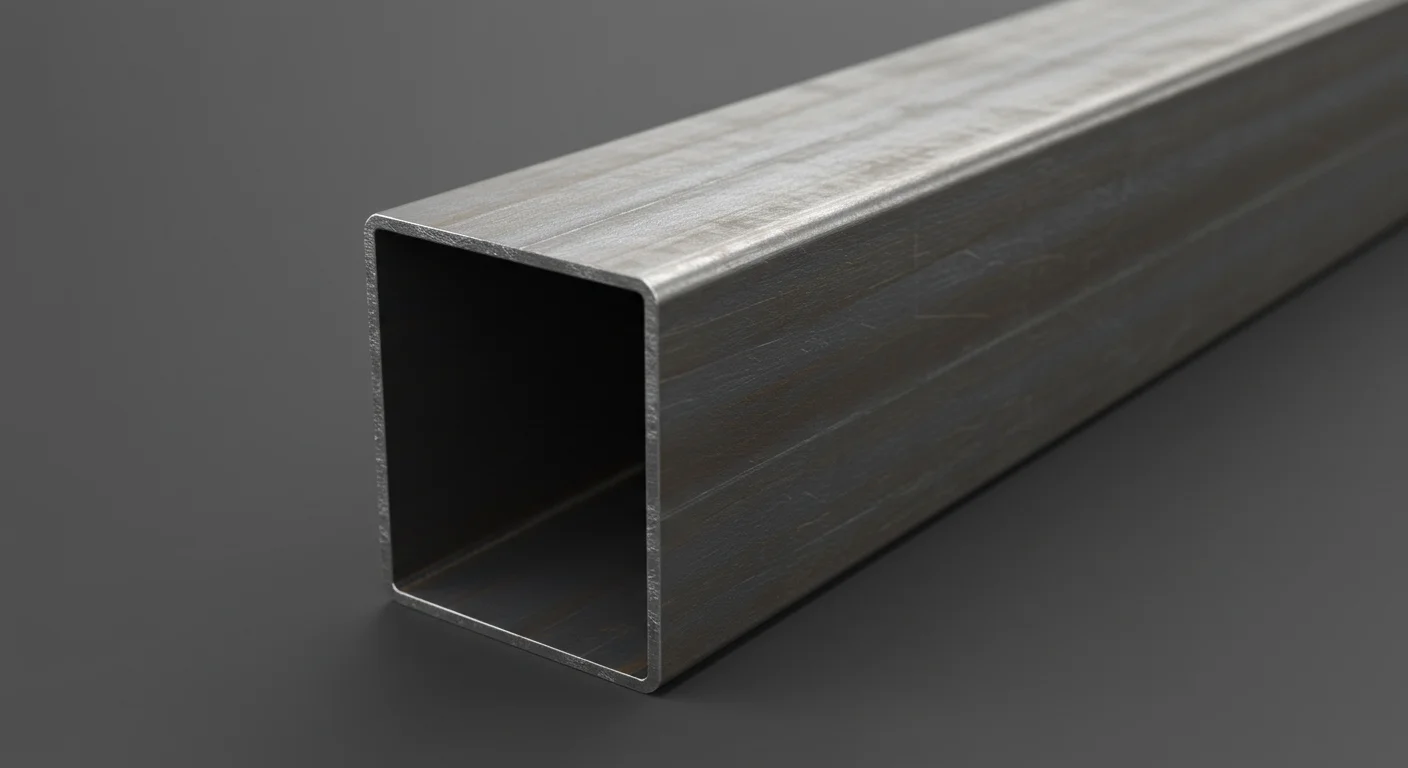

Key Specifications and Standards

- Standards: ASTM / EN / JIS (e.g., ASTM A240/A36, EN 10088/10025, JIS G4304/G3131).

- Surface options: 2B, BA, No.4, HL, mirror; galvanized (electro / hot‑dip).

- Processing: hot‑rolled, cold‑rolled, annealed & pickled, welded or seamless.

- Typical services: slitting, shearing, cut‑to‑length, drilling, beveling, deburring.

- Documentation: MTC, CO, packing list with net/gross weight and heat numbers.

Typical Applications

Construction, machinery, automotive, energy, enclosures and fencing, food equipment (for stainless), and general fabrication. Match grade and finish to corrosion, strength, and appearance requirements.

Selection Guide

- Use certified material with Mill Test Certificate (MTC).

- Confirm standards (ASTM/EN/JIS) and tolerances per drawing.

- Match surface finish to application (2B/BA/No.4/galvanized).

- Specify dimensions and acceptable deviation upfront.

- Plan packaging and corrosion protection for transit.

Processing, Packaging and Logistics

We adopt edge protection, waterproof wrapping, rust‑inhibiting paper, fumigated pallets, and strapping suitable for sea freight. Loading photos and weight lists are provided for each shipment.

FAQs

Q: What lead time can I expect?

A: Typically 7–15 days ex‑works for standard sizes; custom processing may extend the schedule.

Q: Can you provide cut‑to‑size service?

A: Yes. We slit, shear, cut, drill, bevel and deburr to drawing to reduce waste and speed installation.

Q: How do you ensure quality?

A: Incoming inspection, process control, and final inspection with traceable heat numbers; third‑party inspection is available.

Q: Do you support small trial orders?

A: We support pilot quantities with consolidated shipping to control cost.

All values are typical and for guidance only; confirm with the datasheet and purchase order before production.

Related products: view details.

Related products: view details.

Leave a Reply